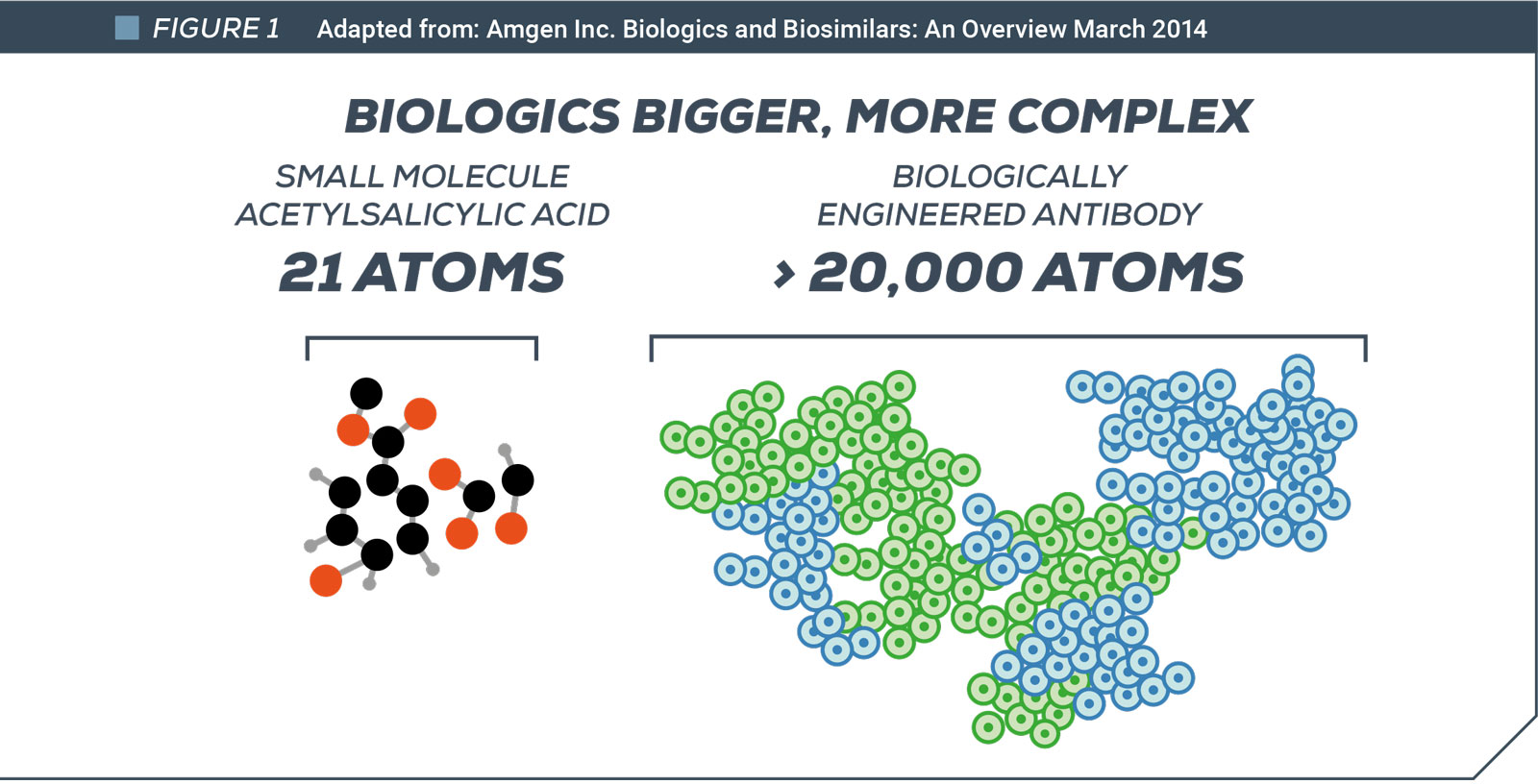

In medicine, the dominance of small-molecule drugs is coming to an end. More future treatments will be biologic – complex drugs with molecular structures many times larger, manufactured inside living structures such as animal cells or bacteria.

The new era of biotechnology promises a revolution in how doctors manage disease, offering hope to patients with conditions for which there is currently no treatment. Advances in gene therapy, the development of safer vaccines, precision medicine and superior diagnostics stand to benefit billions of people.

Despite its transformative potential, research and development (R&D) in medical biotechnology remains concentrated in a handful of countries. The United States by far is the world leader in biotechnological output followed by the United Kingdom, Switzerland, Germany, France and Japan. China has made enormous recent strides and looks set to become a major player in future decades.

The innovative biopharma industry is very much in its infancy in the Gulf region, yet it could play an important role in diversifying away from oil and transitioning towards knowledge-based, more sustainable economic development. Various development plans recognize this, with Saudi Arabia’s Vision 2030 and the UAE’s Dubai Industrial Strategy 2030 and Abu Dhabi Vision 2030 singling out the biopharmaceutical sector as a development priority.

Alongside a robust regulatory environment and adequate R&D infrastructure, an effective intellectual property (IP) system is key to mobilising the large investments needed to fund risky biotech ventures.

To promote innovation in biologic medicines the key IP right is not patents but regulatory data protection (RDP), also commonly known as test data exclusivity. For a limited period, RDP prevents competitors from exploiting the data generated in clinical trials by the original drug developer.

The most innovative countries in biotechnology – including the UAE – have clear rules protecting the valuable data generated during clinical trials

The most innovative countries in biotechnology all have clear, legally binding rules to protect this data. In the Middle East, the UAE has done particularly well in this regard and is reaping the benefit in terms of foreign direct investment in both R&D and manufacturing facilities, rapidly become the pre-eminent regional life science hub. Other countries in the region are faring less well. Some such as Saudi Arabia have these rules on the statute books, but they can be poorly defined and inconsistently applied. Many Middle Eastern countries provide no protection at all.

This uncertainty about the security of intellectual property rights makes the region a less attractive venue for investment. And without foreign partnerships, local companies will struggle to upgrade their technological capabilities and develop into innovative companies in their own right.

Regulatory data protection explained

Regulatory authorities require data from pre-clinical and clinical trials to be able to approve and certify that a medicine is safe and effective for consumer use before market entry. Clinical trials are painstaking and costly. Estimates of the cost of developing a new medicine range from USD1.2 billion (Office of Health Economics, UK) to USD2.6 billion (Tufts University).

In most sectors companies can protect commercially sensitive data through trade secrecy laws, but the requirement for biopharma companies to disclose data to regulators puts them at a competitive disadvantage.

Susan Finston is co-founder of Indian biomedicine start-up Amrita Therapeutics. “A typical food and beverage company can hold trade secrets on their recipes and so forth, and they can do that in perpetuity”, she says. “But if you are a biopharma innovator, you have to disclose to regulators what your cookbook is.”

RDP is critical for biopharma innovators because it ensures that competitors cannot gain regulatory approval and enter the market on the back of an innovator’s test data before the innovator has had a fair opportunity to recoup the costs of compiling it.

“In industries like biopharma or agritech, there is a compelling public interest in regulators having access to the innovators’ test data,” notes Ms. Finston, highlighting the importance of data exclusivity to innovators. “RDP arrangements allow regulators to access that data on the understanding that they will not disclose it”.

Clinical test data and biosimilars

One important reason regulators want access innovators’ test data is to be able to assess follow-on versions of proprietary drugs produced by competitor companies. Just as originators of small-molecule pharmaceuticals face follow- on competition from generics manufacturers, biologic innovators face competition from producers of biosimilars – but with an important twist.

The structure of biologics is far more complex than “traditional” chemically-synthesized drugs making it impossible to replicate precisely an original biologic. The best competitors can achieve is a “biosimilar”, a product that is similar in structure and effectiveness. To obtain regulatory authorization for a biosimilar a company must demonstrate to regulators via clinical trials that its efficacy, quality and safety are comparable to the innovator’s original product. Regulatory authorities can only grant approval if they have access to the innovator’s test data.

This contrasts with manufacturers of generic chemical drugs, who can replicate precisely the originator drug and need only prove it to regulators through far more abbreviated regulatory process.

Why patents aren’t enough

Regulatory data protection grants biologics innovators some much-needed security, notes Dr Kristina Lybecker, associate professor at Colorado College specializing in pharmaceutical IP rights.

“Patent protection and data exclusivity are complementary forms of IP protection that both serve to incentivize the tremendous investments required for the development of biologic medicines,” she says.

But critics argue that RDP is a step too far, effectively extending protection after patent expiry and delaying the development of cheaper biosimilars to the detriment of healthcare providers and patients. Advocates of RDP, on the other hand, argue that patents do not give sufficient protections for this area of technology, and RDP is critical to securing sustained investment in biotech innovation.

“Patent laws give you protection up to a point, but not completely,” explains Jack Lasersohn, general partner at the Vertical Group, a healthcare-focused US-based venture capital firm. “It is more difficult to protect a biologic from a biosimilar than it is to protect a small molecule from a generic that is chemically identical. Patent laws simply do not afford the same level of protection if you are going to allow similar drugs to be approved using the same data,” he says.

In 2010, with strong support from the National Venture Capital Association, the United States enacted the Biologics Price Competition and Innovation Act ushering in a 12-year period of regulatory exclusivity for new biologics from the date of first approval by the US regulator.

Welcoming this development, Jack Lasersohn notes, “Property rights, including patents and regulatory data protection, are the foundation of investment. No-one wants to invest in something that they don’t own a part of. Patents and regulatory data protection give you a form of ownership, and therefore make it possible to invest.”

“When venture capitalists look to make an investment, they need to justify it on the rate of return over time,” he explains. “The return you get is directly a function of the durability of the investment – in other words, how long it will produce cash flows and profit. The shorter the period of durability the less profit that can be made; and the smaller the investment that can be justified. For biotech, that durability is associated with data exclusivity.”

Without the promise of a return on their investment, venture capitalists would have little reason to invest in such a high-cost, high-risk sector – and billions of dollars in funding for cutting-edge medicines would be lost.

In 2019, venture capitalists in the United States pumped a record USD 17.2 billion into biotech startups.

Producing test data costs a lot of money. That, coupled with uncertainty over the patentability of biotech inventions in the wake of United States Supreme Court decisions in relation to, for example, eBay v MercExchange (2006), Mayo v Prometheus (2012) and Association for Molecular Pathology v Myriad (2014), and the challenges of enforcing patent rights further highlight the importance of RDP as a means of sustaining investment in medical biotech, particularly for small companies that struggle to meet the expense of patent litigation.

The international landscape

At the international level, regulatory data protection is governed by the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) of the World Trade Organization (WTO). Article 39.3 of TRIPS requires WTO members to protect test data submitted to regulatory authorities against unfair commercial use and disclosure, except when the public interest so requires or when the data is otherwise protected against unfair commercial use. Protection of proprietary rights to drug registration data became a requirement for all WTO members, with the exception of least developed countries, from January 1, 2000, but many countries have yet to implement it.

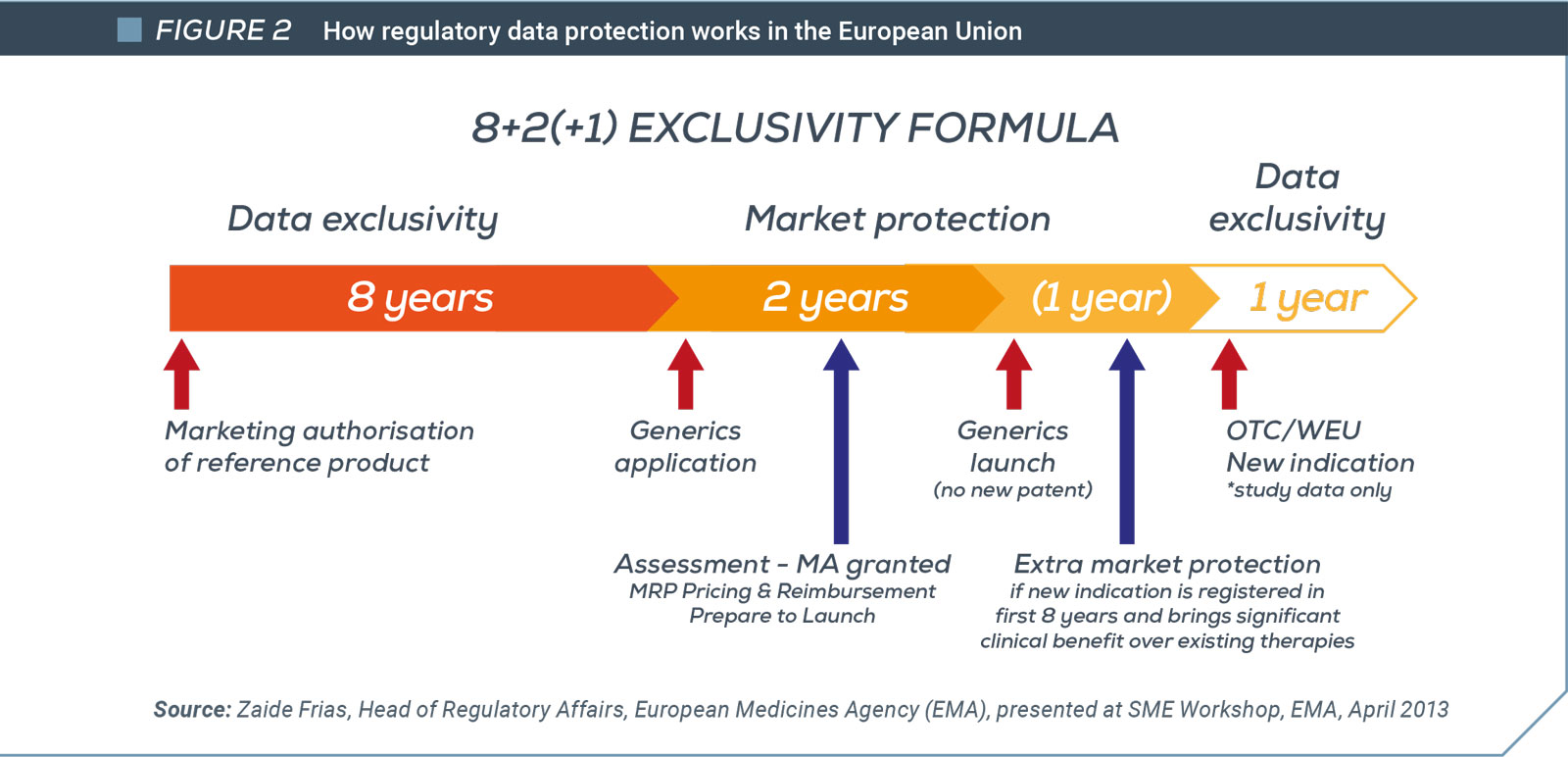

The United States stands alone in offering a 12-year term (in a 2011 paper, Duke University economist Henry Grabowski reasoned that a representative biologic could not recoup its R&D costs with a data protection period of less than 12 years). The European Union provides for up to 11 years of regulatory exclusivity protection in certain circumstances (see Fig 2 – European Union 8+2(+1) formula) – and this particular regime is generally applicable to both biologics and small-molecule drugs.

Canada and Japan each offer eight years of RDP for biologics, while a significant number of jurisdictions make provision for five to six years.

At the other end of the scale, it is typically developing economies that fail to provide any form of RDP for biologics.

Regulatory Data Protection/test data exclusivity in the Middle East

In line with their commitments to WTO TRIPS Agreement, most countries in the region, in principle at least, provide terms of at least five years data exclusivity (see figure below). Saudi Arabia and the UAE are worth mentioning as examples of differing approaches.

United Arab Emirates

United Arab Emirates

The UAE has been notable in recent years for the attention it has paid to upgrading its regulatory and IP environment. As a result, life science companies are increasingly choosing the UAE as a regional headquarters and manufacturing hub.

Investor confidence has been reaffirmed in particular by the authorities’ responsiveness to concerns over the status of RDP in the country, originally arising from the Ministry of Health and Prevention’s (MOHAP) 2017 registering of generic drugs that infringed the IP rights of innovative medicines. Since then, the government has clarified the rules via Decree 321, which provides eight years of regulatory data protection and proper means of enforcement. This makes the UAE the highest standard country in the region for the protection of regulatory test data, contributing to the stability and predictability of its IP system.

Saudi Arabia

Consistent with its obligations under the WTO TRIPS Agreement, Saudi Arabian law requires authorities to protect confidential business information from unfair commercial use for at least five years, if that data had to be shared to gain a marketing authorisation (such as clinical trials data).[1]

Yet the Ministry of Health has defied its government’s own laws by procuring locally-made generic versions of medicines still subject to IP protections, including RDP. This situation has been ongoing since 2016, despite a local court decision in favour of rights holders.

In September 2020, Saudi Authority for Intellectual Property (SAIP) published draft updated regulations for the protection of confidential business information, including regulatory test data. Investors are worried that the draft does not specify a duration for the protection of this data, and that the draft specifically states that relying on data submitted to the drug regulatory authority does not constitute unfair commercial use.

Does regulatory data protection / test data exclusivity undermine access to medicines?

Governments often come under pressure from public health NGOs to avoid properly implementing RDP. They claim it simply enables large pharmaceutical corporations to extend protection of their proprietary drugs after patent expiry, increasing the price of medicines and undermining access.

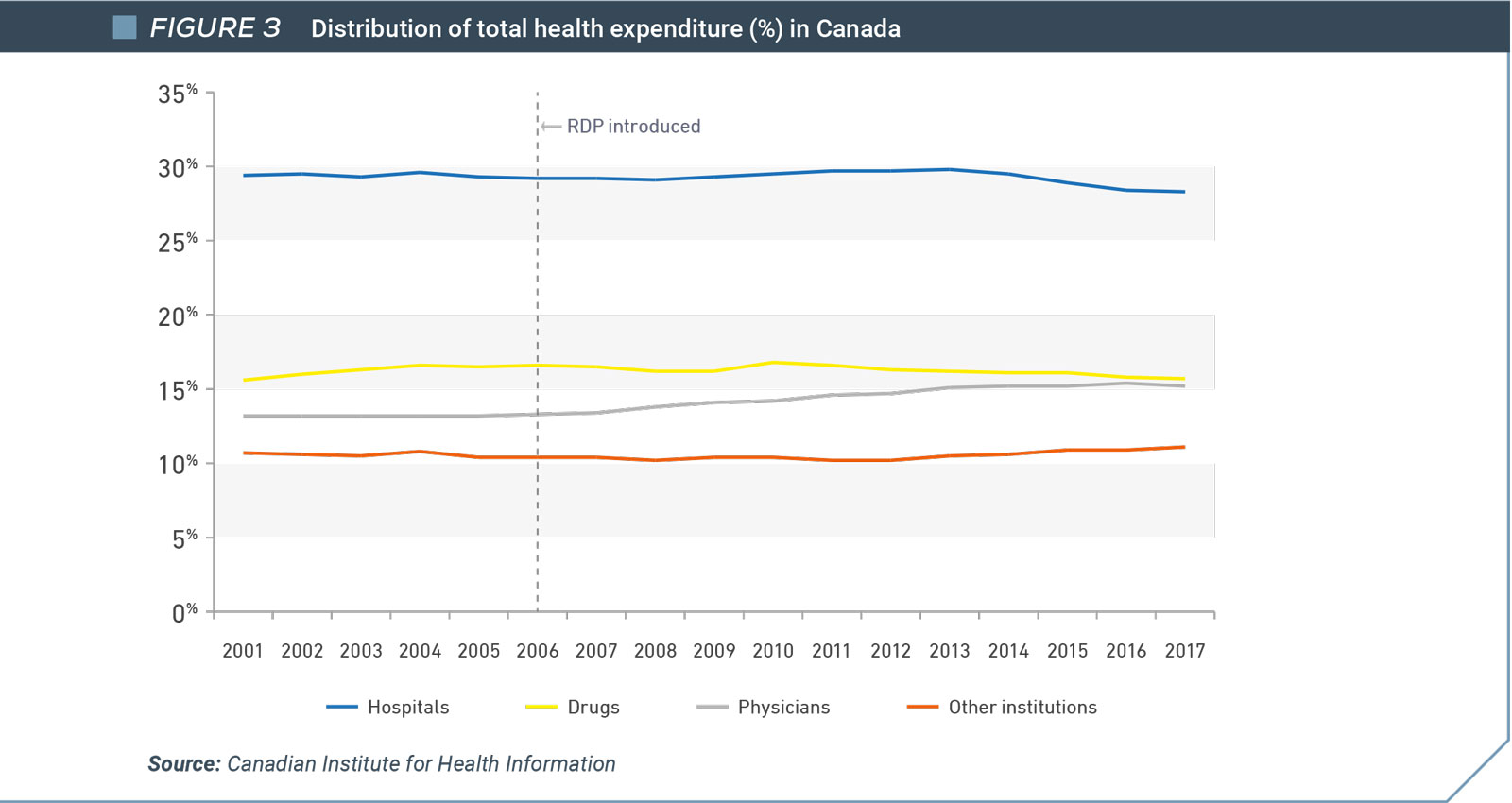

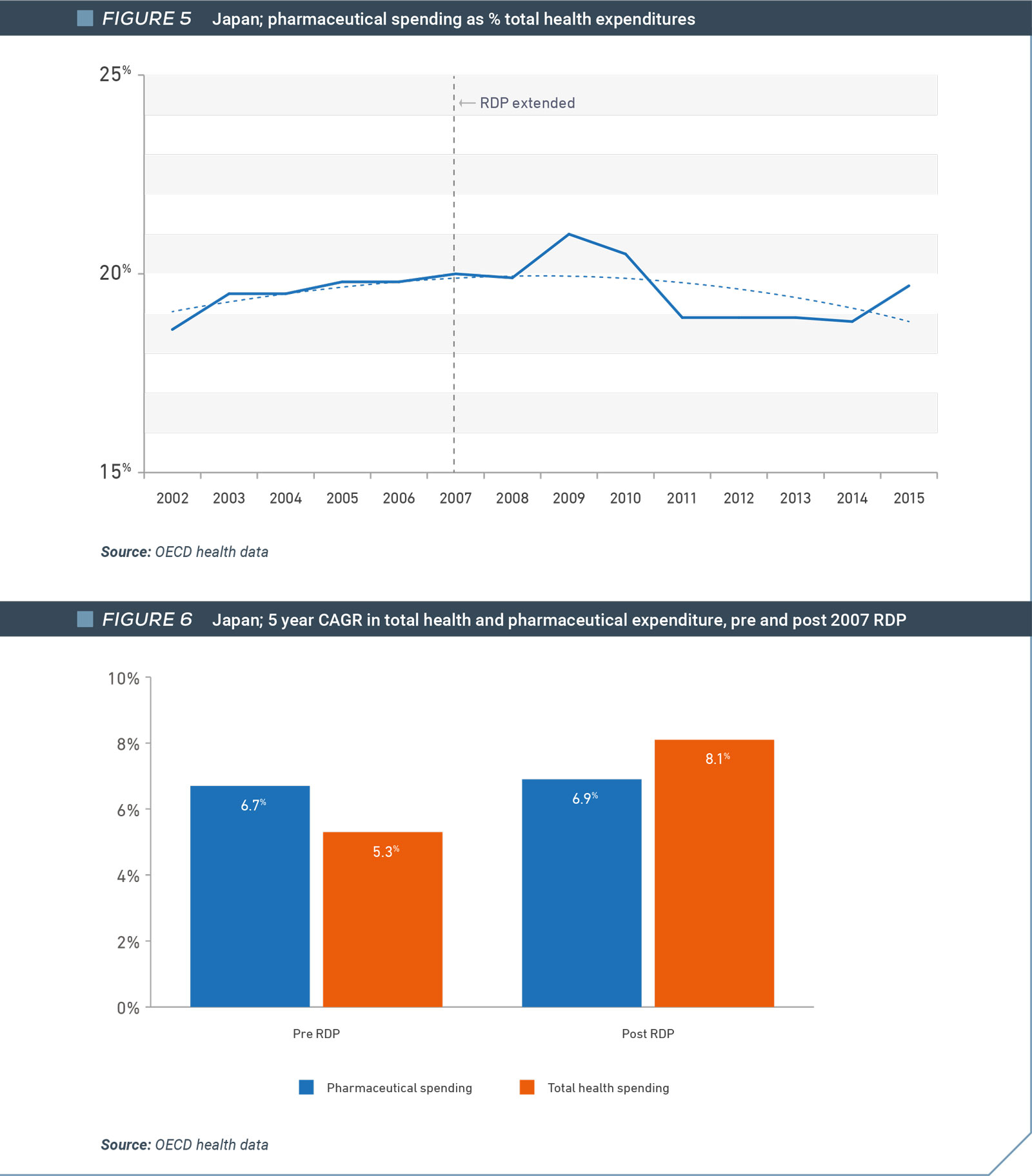

In reality, implementing or extending the term of regulatory data protection is unlikely to drive up health spending beyond existing trends. Evidence from Japan and Canada, which both lengthened their terms of data protection unilaterally in 2007 and 2006 respectively, shows that the increased protection did not raise drug spending as a percentage of overall health care spending or lead to higher growth rates of drug spending.

In 2006, Canada increased its RDP term to eight years. The following year, Japan increased its term of RDP from six to eight years. The experiences of both countries, show that drug spending as a percentage of overall health care spending did not increase, nor did growth rates of drug spending, following the introduction of longer terms of data protection

Spending on drugs as a proportion of Canada’s overall health expenditure is less today than it was in 2006, the year that regulatory data protection was introduced. In fact, drug expenditures declined as a proportion of overall health spend in the years immediately following the change. In contrast, physician costs have increased appreciably (Figure 2).

Although Canada spent more on health care as a percentage of GDP after regulatory data protection was implemented, the percentage of GDP committed to drugs has remained largely unchanged (Figure 3). In fact, spending on drugs as a proportion of Canada’s overall health expenditure is less today than it was in 2006.

As is the case in Canada, drug spending in Japan as a percentage of total health spending declined from 2007, when the government increased regulatory data protection from 6 to 8 years for all new medicines. Drug spending fell from 20% of total health spending in 2007 to 19.7% in 2015, the last year of available data (Figure 8). In fact, the growth in medicines spending remained generally unchanged in the five years after 2007, when the regulatory data protection term was increased. In contrast, growth in total health spending continued to accelerate over the same period (Figure 9).

Developing countries that have implemented data exclusivity provisions as part of Free Trade Agreements have not seen a detectable uplift in drug prices either, according to a 2016 analysis.

Conclusion

Considerations of the cost of RDP must also be weighed against the benefits that new medicines can bring. While RDP shields biologics manufacturers from biosimilar competition, for a limited period, it also incentivizes innovation which results in the development of biologic treatments and cures that might not otherwise come into existence.

These medicines benefit patients, improve and extend lives. The result is healthier individuals and cost savings to healthcare systems. For Middle Eastern countries, any medicine costs saved in the short-term would be more than outweighed by the jobs and economic value foregone as life science companies shun the market as an investment destination. The United Arab Emirates has shown the way regionally, increasing its period of RDP to match the highest global standards. Reforms such as this solidify the UAE’s position as a regional life science investment and innovation hub, and indicate to regional neighbours what can be achieved with the correct policy mix.

If the ambition is to diversify away from oil and bolster knowledge-based industrial sectors, governments in the region must look to strengthen key IP rights such as regulatory data protection.

[1] Article 5 of Council of Ministers’ Trade Secrets Protection Regulation / decision No. 3218, dated 25/03/1426 H, May 4, 2005