Introduction

Many emerging markets are looking to the biopharmaceutical industry as they seek to transition to high-income status and rebuild their economies amid the ongoing Covid pandemic. Countries from Saudi Arabia to Indonesia have identified the sector as a growth priority, hoping to benefit from its high-skilled jobs, economic value-add and the contributions it makes to local health systems.

While a stronger local generic medicine manufacturing industry obviously has benefits, the real prize would be greater investment by the innovative part of the biopharmaceutical industry, given the huge economic and social benefits it can bring.

High-income countries such as Singapore and Ireland have already trodden this path, implementing over recent decades a suite of policy measures aimed at attracting investment from R&D intensive pharmaceutical companies, including strengthening of intellectual property rights, boosting national scientific capabilities and clinical trial and R&D infrastructure.

Investment has flowed into these small countries, with Ireland now a top destination (on a per capita basis) to conduct clinical trials, and Singapore cementing its status as a globally-significant R&D cluster, with biomedical activities that span the entire biomedical innovation and manufacturing value chain.

Many emerging markets looking to emulate this success have improved their investment environment in some areas but have drawn the wrong lessons elsewhere: while Ireland and Singapore’s success is largely down to attracting investment, too many emerging markets are trying to compel it. Specifically, more and more are trying to capture economic and innovation activity by forcing foreign companies to locate operations or assets inside their borders as a condition of market access.

Many emerging markets are trying to boost economic growth and innovation by forcing foreign companies to locate operations inside their borders as a condition of market access.

These “localisation barriers to trade”—such as forcing a company to build a local factory, store data locally, or transfer ownership of valuable technology or intellectual property as a condition for doing business locally—are cropping up across emerging markets. They represent a barrier to trade and impede the ability of businesses to operate normally, raising costs and restricting the local availability of medicines to the detriment of patients and health systems.

In the pharmaceutical sector localisation barriers to trade fall into two main categories:

- local manufacturing as a condition of market participation (including in government procurement);

- forced intellectual property or technology transfer as a condition of market access;

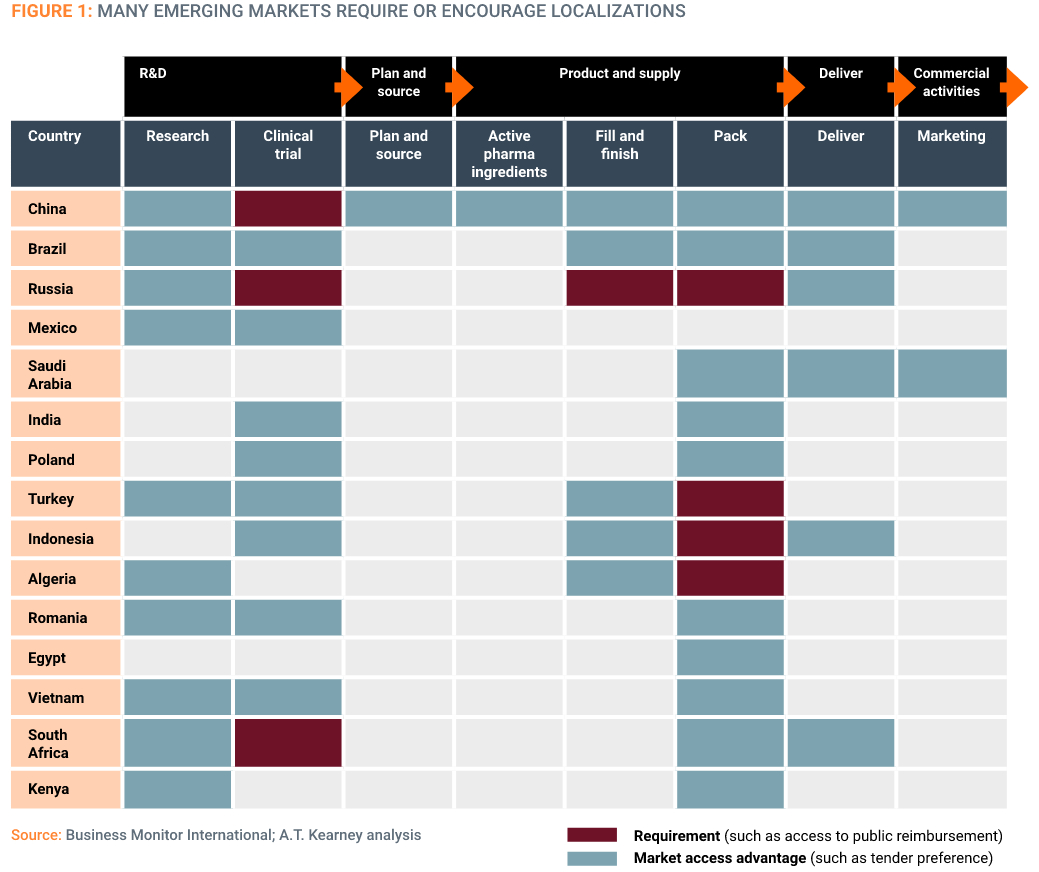

Affected links in the value chain range from research and development and clinical trials to supply chain functions and commercial activities (Figure 1), and the legislative picture is constantly evolving – adding another layer of complexity to operational planning for businesses.

Motivations for localisation policies include the possibility of cheaper products, security of supply and the potential to upgrade industrial capacity, local skills, and ultimately an economic transition towards innovation.

But forced localisation policies rarely achieve these objectives. An increasing body of evidence is showing they are failing to increase employment and foreign investment, and may actually harm the ability of local companies to upgrade their innovative capacities and progress higher up the economic value chain.

This policy brief explores the use of forced localisation policies in a selection of middle-income countries, sets out the evidence on their effectiveness, and suggests an alternative positive policy agenda.

Forced localisation policies fail to increase employment and FDI, and harm the ability of local companies to become more innovative.

The use of forced localisation policies in selected emerging markets

China is perhaps the most famous exponent of coercive localization measures, with a range of interventions spanning the entire pharmaceutical R&D and vaccine value chain (Figure 1). However, many other emerging markets have adopted similar policies. The following provides a snapshot of the current situation (summary in Figure 2).

Brazil

❌ Limits on the ability of foreign companies to operate local supply chains

❌ Mandatory technology transfer

❌ Preference towards locally manufactured medicines in federal government tenders

Although it is not explicitly framed as a localisation measure, only licensed Brazilian legal entities are allowed to hold marketing authorisations before the National Health of Surveillance Agency (ANVISA). Therefore, imported health products may only enter the Brazilian market via a Brazilian importer.

The government is also attempting to bolster the innovative capacities of public sector pharmaceutical laboratories via Productive Development Partnerships (PDPs) which involve a degree of mandatory technology transfer. Specifically, under the PDP regime a pharmaceutical company must transfer the technology for drug production to a Brazilian state laboratory, in return for a period of temporary exclusivity of supply of that drug to the public sector market.

Public tenders for pharmaceuticals are also biased towards locally produced medicines. Federal Decree No. 7,713/2012 dictates a margin of preference for the acquisition of certain drugs and pharma products (defined in the Decree) in federal government tenders, with the aim of developing the local industry. This preference is automatically on average 25%.

Turkey

❌ Bans on imported medicines

❌ No reimbursement for medicines with insufficient local content

The Turkish government is undertaking a strategic push to boost its pharmaceutical industry to achieve policy goals such as increased foreign investment, employment and health systems sustainability. The 2016 Action Plan of the 64th Government mandates that all drugs in the Turkish market must be made domestically where feasible. This “localisation requirement” involves a ban on imported drugs and an implicit request for technology transfer. Should the localization requirement not be fulfilled, Turkish authorities retain the right to reject the drugs from the reimbursement scheme, effectively driving the drugs out of the market. Multinationals are thus forced either to invest in a local manufacturing plant or to outsource to local manufacturers.

The European Union made a formal complaint at the WTO against Turkey’s localisation policy in April 2019. The EU claims it is inconsistent with the GATT 1994 Article III, in that the localization requirement, together with the technology transfer requirement and the import ban on localised products, treats imported drugs less favourably than products of national origin. Moreover, the EU has also claimed the Turkish government has not been sufficiently transparent with the application of the localisation measure, preventing companies and governments from responding appropriately.

In April 2022 a panel from the WTO’s Dispute Settlement Body (DSB) ruled in support of the EU. The key findings related to establishing that this was a single cohesive measure that was discriminatory, that it was unjustified from both a public health and sustainable health system viewpoint, and the prioritisation of local R&D and market authorisation reviews contravened global trade rules.

In July 2022 an appeal arbitration award by the WTO confirmed the Panel’s ruling, ruling that the Turkey’s localisation requirement discriminates against foreign pharmaceutical products. The ruling determined that Turkey’s localisation requirements are not a procurement issue and their objective is not to achieve public health objectives or comply with local laws relating to access to healthcare. The ruling also determined the requirements force companies to relocate manufacturing to Turkey in order to be eligible for public reimbursement, and are therefore incompatible with Turkey’s WTO commitments.

Saudi Arabia

❌ Preference and favourable conditions for local manufacturers versus foreign manufacturers in government procurement

❌ Price preference initiative to promote locally manufactured Active Pharmaceutical Ingredients

❌ Faster regulatory authorisation for locally produced medicines

❌ Rules governing the protection of IP have been strengthened but are not being fully implemented

Saudi Arabia is encouraging local manufacturing of pharmaceutical products, in line with the Vision 2030 initiative. An objective of the related National Transformation Development Plan in the Kingdom is to raise the percentage of local pharmaceutical production to 40 percent from the current 20 percent.

Localisation measures in procurement are central to achieving this ambition. As part of this Saudi Araba recently created a new Local Content Government Procurement Authority (LCGPA), which has been tasked with drawing up lists of pharmaceuticals that must be procured from local rather than foreign manufacturers. The first list of products names more than 100 pharmaceuticals that can only be procured from local providers.

Additionally, LCGPA in 2020 announced a price preference initiative of up to 30 percent for certain locally manufactured pharmaceutical products. The biggest preference is given to medicines that contain locally manufactured Active Pharmaceutical Ingredient (API). The initiative aims to increase the price preference percentage granted to these products when compared to foreign counterparts during the bidding process in government competitions.

Local producers or joint ventures are reported to enjoy shorter product registration times. For imported products, the process often takes years, while for local items the approval time can take as little as three months.

Algeria

❌ Import bans and volume restrictions where locally manufactured equivalent exists

❌ Discrimination against foreign manufactured medicines in the market authorisation process

❌ Faster and seamless market authorisation process for locally manufactured products compared to complex process for foreign manufactured medicines

❌ Preference and prioritization of locally manufactured products in local procurement and tender process

Algeria has long pursued a muscular import substitution industrialisation policy with regards to its domestic pharmaceutical industry with a view to cost-containment and industrial development.

In January 2009 the Algerian government enacted legislation banning the importation of pharmaceuticals that compete with locally-manufactured equivalents. The Ministry of Health now publishes lists of medicines covered by the legislation although foreign pharmaceutical manufacturers complain the lists are drawn up in an opaque and arbitrary manner.

Further, in 2017 the Algerian Government arbitrarily imposed volume restrictions on imports of pharmaceutical products that compete with similar medicines produced domestically and /or imported generic products.

Algeria’s market authorisation process prioritises locally-manufactured products, both in terms of authorisation fees (six times lower for drugs, and authorization timelines (assessment priority is given for local products, with approval timeframe of 5-6 months).

Indonesia

❌ Only locally registered pharmaceutical companies can gain marketing authorization for their products

❌ To gain market access, foreign companies must establish local manufacturing facilities or transfer intellectual property rights to a local company

❌ Imported drugs must be manufactured locally within five years after the first importation, except those still under patent protection

❌ Medicines must have a proportion of local content to be preferred for public procurement

The Widodo government has taken some steps to improve the attractiveness of Indonesia as an investment destination to the biopharmaceutical industry, particularly around IPRs.

Article 20 of the 2016 Patent Law had a particularly onerous requirement for granted patents to be ‘worked’ in the country. Not manufacturing a medicine in Indonesia, or working the right in some other way, could be grounds for the issue of a compulsory licence.

In 2020 the government scrapped the patent working requirement entirely, moving to a system in which patent holders are only required to ensure the availability of patented products in Indonesia via importation or licensing. This shifted Indonesia towards a more investor friendly situation where patent holders do not risk forfeiture of their rights if they do not manufacture locally. The requirement for either licensing or importation helps patients too, as more complex, innovative medicines are more likely to be available via import than if they are required to be manufactured locally.

This progress still leaves in place 2008’s Ministry of Health Decree 1010, which prevents companies from gaining marketing authorisation for their medicines unless they are registered as “local pharmaceutical industry”. This measure means companies have no access to the Indonesian pharmaceutical market unless they either create a local manufacturing facility or transfer intellectual property rights to another pharmaceutical firm with local manufacturing facilities in Indonesia. Decree 1010 also has a requirement for local manufacture of imported products within five years after the first importation with some exceptions such as products under patent protection.

In a further attempt to boost the local pharmaceutical industry, the Indonesian government also makes products with higher local content preferred in public procurement, including medicines (under Presidential Regulation No. 16 of 2018 on Government Procurement for Goods/Services). The government has also been continuously campaigning to prioritize the use of local products across sectors. As well as being discriminatory on a trade policy level, the local content requirements add costs and uncertainty to serving the Indonesian market.

Vietnam

❌ The government is pushing for tech transfer but strategy and guidance are not yet clear.

❌ Procurement priority given to medicines with local content

❌ Limits on the ability of foreign companies to operate local supply chains

Vietnam has emerged as a regional development superstar and central player in global manufacturing value chains, a trajectory that is likely to continue as multinational companies look to divest manufacturing from authoritarian states.

Not content to rest on its laurels, Vietnam is looking to bolster its capacity in more knowledge-based industries, including the biopharmaceutical industry which it as identified as a priority sector in its “National Master Plan for the Vietnamese Pharmaceutical Industry Development to 2020 with a Vision to 2030” (suspended due to Covid but likely to resume in 2022). The plan aims to leverage the Vietnamese pharmaceutical industry to meet public health goals and promote access to quality and innovative medicines.

An ancillary goal is to develop the local pharmaceutical industry itself and to reduce reliance on foreign imports of medicines. By the end of 2030 the Master Plan envisages expanding local production to account for 80% of national supply (in terms of value) and over time build production capabilities for vaccines and biological products for epidemic prevention and develop a system of testing, drug distribution, and drug information comparable to more advanced economies in the region.

To advance this ambition, Viet Nam presides over a complex system of rules which prioritise local manufacturers in government procurement, and force foreign companies to work with local partners to operate their supply chains.

Public procurement rules are particularly discriminatory against foreign medicines. Under the revised Law on Public Procurement, which entered into force in 2014, imported products are banned from participating in public tenders if a bid from a local equivalent exists. In addition, the new rules contain a local content requirement: bids in which domestic production represents at least 25% of the total cost of the product are given priority.

In addition, Decree No. 54/2017/ND-CP dated May 8, 2017 limits the ability of foreign pharmaceutical companies to engage in storage, distribution and transportation activities relating to medicines. These limits require foreign companies to partner with local distributors to import and sell their products on the Vietnamese market and are forced to rely on those partners to ensure the quality and safety of product delivery to patients. However, the foreign company remains liable for any adverse events caused by their products despite having limited control of their storage and distribution.

India

❌ Procurement priority given to medicines with local content

❌ Foreign manufactured medicines required to have increasing levels of local content to be eligible for public procurement

❌ Foreign suppliers banned from tenders worth less than INR 2 billion

The Indian Government’s Make in India policy aims to encourage companies to develop and manufacture domestically, with the ultimate goal of promoting investment and increasing GDP. The biopharmaceutical sector is a key pillar of the initiative, with the government keen to see the industry transitioning from a predominantly low-value generic sector to a more value added industry that both develops new medicines and manufactures them in India.

While the Make in India initiative has seen multiple policies to improve the R&D environment, it also seeks to force foreign companies to manufacture in India. It does this largely by disadvantaging or excluding medicines that are not manufactured in India from participating in public tenders.

On 1 January 2019, the Indian Department of Pharmaceuticals through an Order notified the minimum local content requirement applicable for procurements of medicines and vaccines by Government Procuring Entities. The amendment was announced under the Public Procurement (Preference to Make in India) Order. The order specifies for pharmaceutical formulations that are manufactured in India a local content requirement of 75% in the year 2018-2019 increasing to 90% by the years 2023-2025. For formulations not manufactured in India, the order requires a minimum local content requirement of 10% in 2018-2019 increasing to 30% by 2023-2025

Further the General Financial Rules were amended in 2020 to exclude the participation of non-local suppliers (i.e., suppliers that do not meet the 20 percent minimum local content requirement) from Global Tender Enquiries where the value of the goods to be procured is less than INR 2 billion, except with the approval of the Secretary (Coordination), Cabinet Secretariat.

In sum, these provisions require foreign companies, if they wish to access the Indian market, to increasingly invest in manufacturing facilities in India.

Some modern medicines and vaccines are often the product of globally-dispersed supply chains. Forcing sections to locate in certain countries raises the spectre of shortages in pandemic situations

Shortcomings of forced localisation policies

While the short-term perceived benefits of forced localisation make these policies attractive to policymakers, an increasing body of evidence points to more negative impacts that make the targeted industries uncompetitive and less innovative over time. There are also spillover effects to the rest of the economy that result in higher prices, less consumer choice, and a less diverse and competitive industrial base.

Reductions in imports and exports.

The OECD has studied the impact of local content requirements in various countries around the world. Its 2015 Some modern medicines and vaccines are often the product of globally-dispersed supply chains. Forcing sections to locate in certain countries raises the spectre of shortages in pandemic situations 10 www.geneva-network.com study of 12 local content requirements found they had a net impact that would decrease global trade by USD 23 billion and result in a USD 5 billion loss in global income. In almost all cases where LCRs were implemented, exports in final goods decreased by up to 5%.

Less innovation and investment in R&D.

The OECD in its analysis of local content requirements also found the potential for such policies to inhibit innovation by removing access to technologically advanced inputs, undermining efficiency gains from global value chains. With regards to the biopharmaceutical sector there is clear evidence that forced localisation policies have failed to promote investment in R&D. Countries that make use of such policies have low levels of investment in clinical trials, which are a proxy for high-level and sustained biopharmaceutical investment. Given that many of these countries are major and growing biopharmaceutical markets, this suggests a clear missed opportunity.

Undermines wider economic competitiveness.

Local content requirements lead to unbalanced and unsustainable “dual economies,” with weak productivity growth in non-favoured sectors. The inefficiencies arising in other sectors due to local content requirements actually reduce job growth and opportunities to achieve economies of scale, undermining the original goals for imposing such policies in the first place.

More expensive, less available medicines.

Forced localisation ignores the economic laws of specialisation and comparative advantage. For medicines, this often means that locally produced products are often more expensive than those imported, or not available:

- In Ethiopia, one survey shows that locally-produced medicines are 45% more expensive than imported produced, with eight of nine medicines procured as both local and imported products cheaper when imported.

- In Tanzania, research shows locallyproduced medicines are less available, with patients paying slightly more.

- In Vietnam, drug prices on the lowestpriced generics have been more than 10 times higher than that predicted by WHO modelling, and have increased at an average rate of nearly 8% per year. Local bids winning government procurement tenders can be 150-250% higher than imported products.

- ARV medicines brought in Africa via international procurement can be up to 25% cheaper than those manufactured locally.

Forced localisation policies and the biopharmaceutical industry

Modern biopharmaceuticals are complex products which are frequently manufactured across different countries in globally dispersed value chains. Attempts to force companies to locate all or part of their manufacturing stages ignore this reality, making it unnecessarily expensive to serve particularly smaller markets. In this case prices may rise or manufacturers may forego the market altogether, leading to lessened availability for patients.

Requirements that force localisation in return for market access are a particular risk for public health in the case of drugs and vaccines critical to public health programmes, particularly pandemics. Many of these products, particularly vaccines, are the product of globally dispersed supply chains and it may not be practicable to locate arbitrary proportions of manufacturing locally. Strict local content provisions thereby raise the spectre that certain essential products may not be available, creating a risk for public health and undermining responses to pandemics.

Forced localisation policies also raise questions about the availability of patented / proprietary therapies, particularly procurement policies which require a certain proportion of content to be manufactured locally. Unless there are specific exemptions or clarity around such products, these policies raise the risk that innovative therapies will not be procured where such drugs are only manufactured overseas. This will have a significant negative impact on patients who rely upon innovative therapies for cancer, rare diseases and others.

Sometimes there will be only one local manufacturer of certain medicines, even though there may be multiple foreign suppliers serving the global market. In these instances, the requirement to prioritise the local manufacturer may not lead to the cheapest price as the local supplier will in effect have a monopoly position. In cases where there is only one local supplier, relying on one local supplier also poses risks to the reliability of supply.

Further, the requirement to transfer valuable intellectual property rights to local companies in exchange for market access undermines their value and weakens the overall IP environment. This makes the market far less attractive both for supplying and Foreign Direct Investment.

A better approach to attracting biopharmaceutical investment

While the need to encourage local pharmaceutical manufacturing is an understandable and legitimate policy objective, the foregoing shows that governments frequently deploy coercive and ultimately counterproductive tools to try and make local firms more innovative and competitive.

Instead of addressing the wider factors that help local firms develop innovative and manufacturing capacity, such as better education and infrastructure, too many governments opt for short-term solutions that discriminate against foreign companies, distort trade and the wider economy, and fail to achieve many of their ultimate policy goal of making local industry more internationally competitive.

A better approach to attract needed investment in the biopharmaceutical sector is to address the factors that make a country more attractive as an investment destination. At the macro level, this would include the broader economic climate including predictable and stable fiscal and monetary policy, an outward looking trade policy, open and well-regulated domestic markets and a strong rule of law.

High tech biopharmaceutical manufacturing also requires high standards of physical infrastructure in the form of reliable electricity, clean water supplies and access to transport infrastructure including international air freight. Reliable electricity and water supplies cannot always be guaranteed even in many emerging markets, with electricity load shedding and water rationing common. A reliable phone and broadband network are essential to allow the free flow of data and information, an increasingly critical input to biopharmaceutical R&D.

Of potentially equal importance is a large reservoir of skilled workers, who are necessary to perform R&D and staff high-tech manufacturing facilities. A strong science base and infrastructure is key to any decision to invest. Accordingly, many innovation leaders have made education and training central to their innovation strategies. For instance, Korea has made a commitment to universal education, ensuring that all homes have access to high quality online learning tools. Finland regularly surveys global corporations to understand what skills will be required in future and advises the education system what future skills will be needed to compete.

The medicine regulatory environment is also key, with the presence of a well-resourced national drug regulatory authority that can review applications in a timely and efficient manner ensuring all products submitted for market authorisation meet stringent criteria for safety and efficacy. A regulator that is overly bureaucratic, slow and biased towards local companies will act as a strong disincentive to investment.

There are delays 0f around two years in Brazil and Colombia, and average delays of 400-500 days in India, Taiwan, Singapore, South Korea and Malaysia. Indonesian patients must wait for nearly three years and Chinese patients over two years. These delays will need to be addressed to make a market a more attractive location for biopharmaceutical investment.

Finally, strong and enforceable intellectual property rights are a pre-requisite for any rights holder to consider investing in a country, either directly or via out-licensing or joint ventures. Strong intellectual property protection has been shown to drive Foreign Direct Investment, with the OECD finding that a one percent increase in the strength of patent protection equates to a nearly three percent increase in FDI across all countries. Similarly, the OECD also found that more effective trade secret protection is also associated with increased FDI, as well as greater investment in R&D.

In fact, IPR strengthening in countries—particularly with respect to patents—is associated with increased technology transfer via trade and investment, A country’s level of intellectual property protection considerably affects whether foreign firms will transfer technology into it. Stronger IP protections are associated with speedier in-country launches of new drugs; and conversely, weak IP rights are associated with new drug launch delays of many years. This suggests that a stronger IP system will have positive impacts on both the biopharmaceutical investment climate, and also the health of the population as new medical technologies become more rapidly available.

While it is clear that no single measure alone can promote foreign direct investment in local pharmaceutical industries, certain far-sighted countries have recognised that a holistic approach to the policy and business environment can lead to great things. Singapore is perhaps the most notable example in Asia of a country that has put itself at the centre of global and regional biopharmaceutical investment, through a judicious mix of policy incentives, infrastructural investments and improvements to the business environment (see box).

Unfortunately, there are many more countries that are taking an alternative path, forcing companies to invest or transfer technology in return for market access or license to operate. Given the lack of innovation progress in the countries discussed in this paper, it is time to consider more persuasive, sustainable approaches to attracting biopharmaceutical investment.

SINGAPORE: THE RIGHT POLICY MIX FOR LIFE SCIENCE SUCCESS

One example of a rapidly growing economy achieving success in attracting biopharmaceutical investment is Singapore. Since 2000 it has transformed from a marginally important pharmaceutical manufacturer to a global and regional hub for biopharmaceutical investment across the entire innovation and manufacturing value chain. The government has achieved this by making the country a more attractive place for investment through reforms to education and scientific infrastructure; good access to finance; improving physical infrastructure; and a supportive environment for regulation and the protection of intellectual property rights.

One example of a rapidly growing economy achieving success in attracting biopharmaceutical investment is Singapore. Since 2000 it has transformed from a marginally important pharmaceutical manufacturer to a global and regional hub for biopharmaceutical investment across the entire innovation and manufacturing value chain. The government has achieved this by making the country a more attractive place for investment through reforms to education and scientific infrastructure; good access to finance; improving physical infrastructure; and a supportive environment for regulation and the protection of intellectual property rights.

Thanks to this pro-active approach, growth in the biomedical manufacturing industry has outpaced the overall manufacturing sector since 2000 (7.77% vs 0.68%). In 2000 there were no biologic drug manufacturing facilities in Singapore but by 2019 there were around 18. From 2000 to 2019, biomedical manufacturing was the fastest-growing manufacturing sector, with a compound annual growth rate (CAGR) of 9% (compared to a 5% average growth rate for the whole of Singapore’s manufacturing sector).

Singapore has also become a biomedical innovation hub, with Singapore employing five times more biomedical researchers per capita than the US (128 biomedical researchers per 100,000 residents in Singapore versus 24 in the US).

Researchers from the University of Cambridge (United Kingdom) identify a number of policy measures that have supported Singapore’s success in attracting biomedical investment and boosting domestic manufacturing and R&D:

- Government-sponsored global headhunting of the world’s top scientists,

- Government venture capital for private-sector industrial projects

- Scholarship programmes for human resource formation in leading global and local universities

- Publicly funded research institutes and a biomedical science park

- Holistic integration of research activities

- Tax incentives

- Strong regulatory and Intellectual Property frameworks.