by Philip Stevens

In a world where investors can choose between different jurisdictions, successful innovation economies must have IP policy frameworks that go beyond the minimum provided by the WTO TRIPS Agreement.

This paper discusses two reforms that can help Brazil become the Latin American life science leader.

Brazil’s urgent quest for growth

Brazil’s economy is at a crossroads. Covid-19 has left economic scars including rising inflation, unemployment and inequality. The real has depreciated and the country has lost much of its industry over the last two decades, declining from 26% of GDP in 1980 to 11% in 2018. The Brazilian economy has become dependent on commodity exports, which themselves are prone to unpredictable global forces outside of Brasilia’s control. International investors’ confidence in the country is fragile and must be rebuilt by the new administration.

To create jobs and more sustainable economic growth, Brazil must accelerate and consolidate its economic transition from basic manufacturing and commodity exports towards higher-value, knowledge-based industries. These industries – including biopharmaceuticals, information technology, chemicals and entertainment – underpin sustainable growth and employment in the economies of almost all high-income countries, with China also making great efforts to reorientate its economic model in this direction.

To be successful in the future, Brazil must also boost its innovation industries, but this requires the right policy framework. Alongside a friendly regulatory, skills and fiscal environment, a key but often overlooked policy area is the protection of intellectual property (IP) rights.

A strong and predictable IP framework helps local entrepreneurs secure investment for their innovations and build viable businesses. Multinational knowledge-intensive companies, who bring with them skills, knowledge, and much needed capital, will invest in Brazil. High tech products will be launched more rapidly, opening to citizens all kinds of health and productivity enhancing technologies. This is part of the recipe for sustainable economic growth.

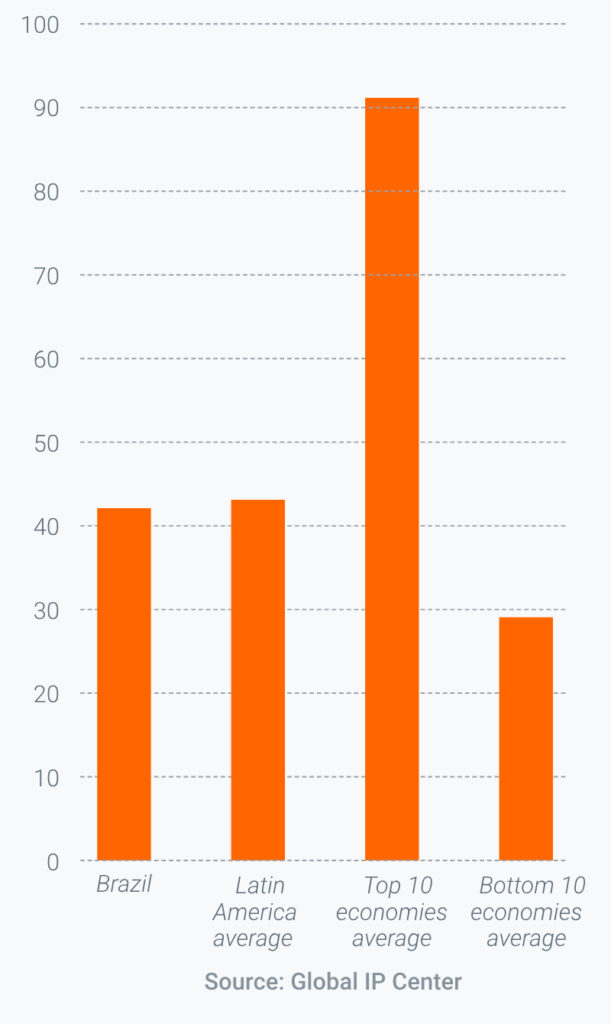

The previous administration made some movement towards further improving the IP environment for investors, including the establishment of a new Inter-ministerial Group on Intellectual Property to coordinate and oversee all issues relating to IP policy in Brazil. Nevertheless, Brazil still underperforms the world’s best economies for the protection of IP (Figure 1).

FIGURE 1: BRAZIL’S PERFORMANCE IN THE 2022 GLOBAL IP INDEX

In a world where capital is mobile and investors can easily choose between different jurisdictions, successful innovation economies must have IP policy frameworks that go beyond the bare minimum provided by the TRIPS Agreement.

Indeed, to be successful in the modern economy, countries must provide IP protections that cater for developments in new technologies, while providing predictability and certainty. Here, there are two reforms that would benefit the Brazilian IP environment and make it far more internationally competitive: regulatory data protection for medicines; and legislation to guarantee inventors enjoy the full term of their patents.

Regulatory data protection

In medicine, the dominance of small- molecule drugs is coming to an end. Future treatments will be biologic – complex drugs with molecular structures many times larger, manufactured inside living structures such as animal cells or bacteria.

The new era of biotechnology promises a revolution in how doctors manage disease, offering hope to patients with conditions for which there is currently no treatment. Advances in gene therapy, the development of safer vaccines, precision medicine and superior diagnostics stand to benefit billions of people.

Regulatory data protection (RDP) protects against both disclosure of test data and, for a limited time, third-party reliance on data either directly or by reference. Essentially, RDP prevents competitors from inappropriately relying on the data generated in clinical trials by the original developer of the medicine or agricultural chemical, which they are obliged to disclose to regulators to gain regulatory approval for the new product.

Clinical trials are becoming increasingly costly and complicated and add significantly to the cost of developing a new medicine or chemical. In most sectors companies can protect commercially sensitive data through trade secrecy laws, but the requirement for biopharma companies to disclose data to regulators puts them at a competitive disadvantage.

A sufficient term of regulatory data protection therefore gives innovators enough time over which they can recoup the costs of compiling clinical trials data before it is made available to generic or biosimilar manufacturers to use in their own marketing approval applications. In the case of biologic medicines, the protection of clinical trial data is also important since patents alone may provide insufficient protection. This is because the molecular structure of biologics is far more complex than “traditional” chemically-synthesized drugs, making it impossible to replicate an original biologic precisely. Given that each biosimilar is slightly different from the originator, patents may offer only limited protection, as patents are granted for specific inventions and do not cover the variations that will inevitably arise in the process of developing a biosimilar.

As such, the most innovative countries in biotechnology, chemicals and veterinary medicines all have clear, legally binding rules to protect these data. This form of intellectual property right is particularly important for countries looking to enter the R&D value- chain through the provision of clinical trials and related services – Brazil being a good example.

Regulatory data protection is available to innovators in the countries that lead biopharmaceutical investment, and China is looking at increasing its standards to improve competitiveness and the innovative capacity of its economy (Figure 2)

FIGURE 2: REGULATORY DATA PROTECTION IN SELECTED COUNTRIES

In 2002, Brazil introduced RDP for veterinary, fertiliser and agricultural products, while explicitly excluding biopharmaceuticals. As Brazil looks to improve its international competitiveness, the government is debating whether to reverse this position and join the many other countries that provide RDP.

Brazil has historically been reluctant to provide RDP because of concerns around access to medicines, with opponents arguing that providing RDP would lead to higher drug prices and place a strain on health budgets. Such fears fail to look at the bigger picture and are unfounded, according to a new study from economics consulting firm Copenhagen Economics. Reviewing data from 53 countries over ten years on this question, its analysis suggests the provision of RDP can bring a host of public health and economic benefits.

RDP increases medicine availability

The main benefit of RDP is that it brings more innovative medicines to a country, more quickly. Countries with RDP demonstrably have more innovative medicines available, most likely because the existence of this intellectual property right provides innovators with certainty and strengthens the business case for investing in medicine launch in a new market. Copenhagen Economics finds that countries with RDP have on average availability of 31.5% of medicines launched in the last five years, compared to only 11 per cent availability for countries without RDP – three times as many.

Using this data, the researchers go on to estimate that Brazil could see up to 39% increase availability of innovative medicines if it were to introduce RDP. That equates to 570 more innovative medicines available in the country. This could transform healthcare in Brazil, with patients able to benefit from modern treatment regimes which might not currently be available.

The evidence shows that Regulatory Data Protection rules bring more new medicines to a country, more quickly.

RDP has minimal impact on healthcare spending

Brazil has been reluctant to introduce RDP for biopharmaceuticals because of the perception that it will increase medicine spending and upset public health budgets. Countries that have introduced RDP have not found that to be the case in the long term, according to the Copenhagen Economics analysis. In aggregate, countries that have introduced RDP found that health spending did indeed increase marginally in the short-term, but settled at its original growth pathway after five to ten years. Three reasons are suggested for this pattern:

- Most obviously, introducing RDP does not extend the period of protection for most currently available medicines. In Brazil, the researchers found that 85% of medicines had a patent term remaining of at least five years, meaning the introduction of five years RDP would have no impact on generic entry for these innovative medicines. This means that generic entry continues to exert a downward pressure on healthcare costs.

- Countries that have RDP have more innovative medicines available to their healthcare systems. Spending on these medicines can lead to significant overall healthcare system savings as patients switch from older, less effective treatments. This can mean less visits to healthcare facilities, fewer surgeries and in-patient stays. Importantly, healthier patients can re-enter the workforce, adding to wealth creation while reducing welfare expenditures.

- Healthcare spending is under political control, and leaders will allocate resources according to local needs and priorities, regardless of modifications to the IP system. Japan and Canada both introduced RDP in 2007 and 2006 respectively. Since then, spending on medicines as a percentage of overall healthcare expenditures has remained stable.

RDP will boost Brazil’s generic medicines and biosimilars industries

Brazil has a large and thriving generics industry that supplies much local demand and exports regionally. To avoid stagnation, this sector relies on a continual stream of innovative medicine launches and the eventual expiration of their intellectual property rights. When a medicine becomes available for generic competition, generic manufacturers rely on the investments made in launching these products, especially the valuable clinical trials data that mut be submitted to regulators to gain market authorisation.

For Brazil, Copenhagen Economics estimates that providing RDP would deliver great benefits to the local industry. Their analysis suggest that RDP would increase the availability of innovative medicines by 34-39% compared to the current level. Over time, after the expiry of IP protection periods, 3.17 generic or biosimilar medicines could become available in Brazil for each available innovative medicine. This suggests that RDP is an opportunity for growth over time, not a threat, for generic and biosimilar manufacturers in Brazil.

Brazil could increase its number of clinical trials by 138% with the introduction of regulatory data protection.

More clinical trials will happen in Brazil

A final benefit of introducing RDP to Brazil is its potential to increase Foreign Direct Investment, a crucial consideration for a government looking to address domestic economic challenges. In particular, the introduction of RDP is likely to drive investment in clinical trials, which in addition to providing FDI, also delivers a host of benefits to the local healthcare system. As more clinical trials data is produced in Brazil, medicines can be better integrated with Brazilian patients, physicians, research facilities, academia, and government agencies.

The Copenhagen Economics study finds that markets with RDP have on average 21 clinical trials per million capita, while markets without RDP have on average 4. This means a difference of 17 clinical trials per million capita. For Brazil, their statistical analysis shows the average number of clinical trials in Brazil could increase by 138% from 445 currently to 1,059 with the introduction of RDP.

This increase in clinical trials activity would facilitate investments by international companies. Additionally, the management of clinical trials is an important step on the transition towards de novo biopharmaceutical innovation for local pharmaceutical companies, contributing to R&D and the wealth this activity brings.

Patent term adjustment

As a member of the World Trade Organization’s TRIPS Agreement, Brazil has committed to grant patents of a twenty-year term (from the date of filing). To receive a patent, inventors must publicly disclose their invention in exchange for a temporary exclusive right to the invention – balancing the need to incentivise inventors to invest in and commercialise new technologies with society’s need for new, accessible technologies. This social contract is at the heart of the patent system, driving innovation and competition by allowing others to invent around and improve the product, while ensuring society benefits.

In practice, in Brazil few inventions receive anything close to this twenty-year period of protection. The twenty-year term starts running down from the moment of filing with the patent office. However, delays and backlogs while the patent office (INPI) examines each patent means that it takes an average of 6.9 years for patents to be granted.

This average 6.9 year delay (longer in certain industries) effectively removes the ability to rely on a patent, thus depriving the owner of the full term. While an innovator might begin selling a product while its patent is pending, the reality is often quite different. Startups often find it difficult to secure the investment needed to build a business unless or until a patent is granted. Even larger companies hesitate to develop a market until they know they have secured patent protection. Moreover, while Brazilian law allows suits for infringement that occurred before the grant of the patent, there is a five-year limitation period – shorter than the average eight-year delay.

Moreover, this delay is outside of international norms. Patent offices in the U.S., China, Korea, Europe and other economies average 2 – 4 years. Indeed, Brazil’s 2019 reforms set two years as a goal.

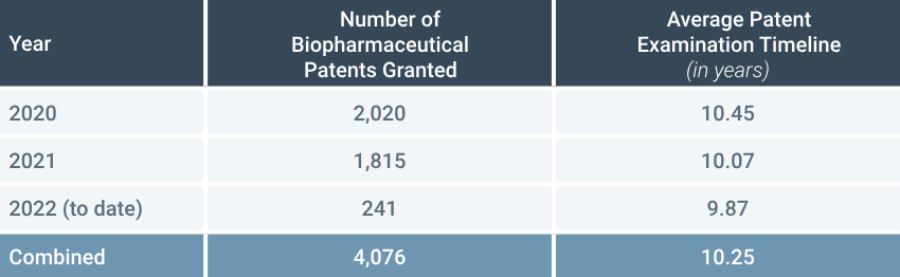

Delays for certain fields of technology, such as biopharmaceuticals are particularly acute. Analysis by Osha Bergman Watanabe & Burton LLP (Osha), shows that the average patent examination timeline in Brazil is 10.25 years for biopharmaceutical patents granted between 2020 and 2022 (Figure 3).

Moreover, the problem of examination backlogs for biopharmaceutical patents Brazil shows signs of worsening, with around 13,688 biopharmaceutical patents pending in March 2022 according to Osha. Despite this, the examination rate by INPI seems to be slowing, with the number of patents examined and granted since 2020 decreasing each year from 2,020 in 2020 to 1,815 in 2021 to an estimated 1,400 for 2022 (based on the number processed to date).

FIGURE 3: Biopharmaceutical Patents Granted from January 1, 2020, through to March 23, 2022

Previously, some compensation for these patent examination delays was provided by Article 40’s guarantee of a 10 year patent term. But the decision in May 2021 by the Supreme Court, finding that Article 40 is unconstitutional for all technologies and applying the decision retrospectively to pharmaceutical products and other health related inventions only, removes this important backstop from Brazil’s IP regime.

The decision leaves innovators in Brazil working with a patent system that ascribes little value to their inventions, putting the country far below the IP standards of the countries with which it is trying to compete for investment. For example, the average time to grant a patent is 2.8 years in Korea, 2.9 years in China and under 2 years in the United States, meaning that innovators in these countries enjoy far longer effective patent life.

Patent examination delays hurt the economy and society

Brazil’s lengthy patent examination system hurts its economy in several ways.

- First, delays in patent examination hurt entrepreneurs and undermine the ability of new businesses to develop and grow. Startups rely on outside investment, and investors typically want to see patents to secure their investments. Research shows that every year of delay reducing start ups’ sales, employment levels and the likelihood of going public with a stock offering.

- Second, delays also hurt society. According to the UK Intellectual Property Office the combined losses from backlogs just at the US Patent and Trademark Office, Japan Patent Office, and the European Patent Office cost the global economy over US$10 billion a year through lost investment, jobs and products.

- Finally, patent office delays hurt consumers and patients by delaying the market entry of new products, technologies and medical treatments. This is especially true of medicines, where research has shown a link between delayed availability of new drugs and weak patent protection. These launch delays are unsurprising, given the significant investments that must be made in each new market for regulatory approval, infrastructure development and medical education for each new medicine. If a patent grant is delayed, these investments won’t start until the patent is granted, meaning slower access to new medicines.

Above all, for the patent system to achieve its economic and social objectives and provide an enabling environment for innovation it needs to be stable and predictable. Swift patent examination is fundamental to this.

In 2019 a new initiative was announced, the Backlog Fight Plan (Plano de Combate ao Backlog de Patentes). INPI has passed several administrative resolutions over the last few years, all aimed at accelerating the decision- making and patent prosecution process for applications with and without existing prior art searches and documentation.

While these send a useful political signal, they do not ultimately incentivise the patent office to speed up its processes, and neither do they provide compensation to rights holders who suffer from patent terms eroded by no fault of their own.

Why patent term adjustment matters

To address the problem of lengthy patent examination, increasing numbers of countries have mechanisms to restore a portion of the patent lost due to unreasonable examination delays, commonly known as Patent Term Adjustment (PTA). This is a reform Brazil should seriously consider to restore patent life in the absence of the sole paragraph of Article 40, and ensure the Brazilian patent system is comparable to its peers internationally. It would differ from Article 40, in that it would apply on a case-by-case basis providing an adjustment based on any unreasonable delay experienced by (and not the fault of) the particular applicant.

PTA for patent office delays is in use by patent offices all over the world, including OECD members Chile, Colombia, Costa Rica, Mexico, Korea and the United States. While the schemes differ in their precise details, they all deploy various formulas to calculate the period of patent life that should be restored due to delays in the patent examination process that are not the fault of the applicant.

In this way, PTA schemes ensures patent life is meaningful, providing certainty and stability for innovators, and ultimately helps the patent system fulfil its intended social and economic role.

OECD member and regional neighbour Chile, for example, enjoys higher standards in many areas of its patent system, including the provision of Patent Term Adjustment to compensate for delays in the examination of patents. Thanks to this and other measures, innovators in Chile enjoy far speedier average examination times of around four years (still not perfect, but an improvement on Brazil’s 6.9and upwards). As of June 1, 2021, amendments to China’s patent law implementing such a system went into effect, showing how seriously the issue is taken by countries that prioritise innovation.

Patent Term Adjustment is similar but distinct from Patent Term Extension (Supplementary Protection Certificates in the EU) which restore patent life for biopharmaceutical patents caused by delays in the regulatory approval process. While Patent Term Extension is available only to medicines, Patent Term Adjustment is available to patents from all forms of technology. It is important to note that PTA does not constitute an extension of patent life, but rather a partial restoration of the time lost to bureaucratic delays.

Patent Term Adjustment exists all over the world, including in OECD members Chile, Colombia, Costa Rica, Mexico, Korea and the United States.

Conclusion

Given its existing science base, biodiversity and strengths in pharmaceutical and other forms of high-tech manufacturing, Brazil is well placed to reorient to a higher- value knowledge economy. A robust and predictable framework for the protection of intellectual property rights will be key to this transformation.

Much is at stake. Brazil has announced its intention to accede to the OECD, an achievement that would confirm the country as a top investment destination benefitting from high standards of governance. This process will require deep reforms to multiple areas of governance, including the framework for the protection of intellectual property rights.

Brazil has some of the IP basics in place, but Brazilian leaders recognise that in the global competition for investment, minimum or subpar IP standards are not enough. Brazil must make itself attractive to both international and domestic innovators. Improving IP protection for the next generation of biologic medicines via RDP, and providing legislative guarantees on meaningful patent life via PTA are two simple reforms that can make Brazil stand out from the crowd and ensure its international competitiveness.