By Matthias Bauer and Philipp Lamprecht

The Covid-19 pandemic has illustrated the importance of international trade for access to all kinds of medical supplies, with many countries suffering from shortages of essential medical goods as a result of various government-imposed trade barriers. The negative impact of these new restrictions is now the subject of high-level political attention. Both within the policy response to Covid-19 and more broadly, the substantial adverse impacts of government-imposed import tariffs on global access to medicines and medical goods is still largely unaddressed.

Due to their effects on production and prices, import tariffs on pharmaceuticals and medical goods are inimical to affordable access to medicines and medical products. Because of their amplifying effect throughout the supply chain, import tariffs significantly inflate the wholesale and final prices of pharmaceuticals (up to 80% of the ex-factory sales price, according to one recent analysis) and active pharmaceutical ingredients (APIs) (ECIPE, 2017), as well as inputs to vaccines and materials supporting their distribution (OECD, 2021). Import tariffs on a wide range of medical supplies, medical equipment and personal protective products also inflate their domestic prices, thereby worsening affordability and access.

Price inflation, however, is not the only damaging impact on patients. High tariffs also reduce supply – in the case of medicines, reduced exports and imports translate into fewer choices and less availability at the pharmacy counter or hospital.

The following policy brief provides an overview of current tariff policy for medical goods; shows economic estimates of the effects of tariffs on supply in different countries; and recommends the inclusion of tariff elimination for medicines, APIs and a broad spectrum of medical goods in ongoing discussions regarding trade and health.

WTO bound and applied tariffs on medicines and other medical products are still high.

Tariffs are essentially regressive taxes as they take a higher proportion of income from the poor than they do for those higher up the income scale – in fact, pharmaceutical tariffs are doubly regressive as the hardest hit are poorer people suffering from disease. Tariffs on chemical inputs such as APIs also undermine the competitiveness of local pharmaceutical industries (Olcay & Laing 2005). The World Health Organization has thus recommended that governments should “remove or reduce taxes and tariffs on essential medicines” (WHO 2003).

Despite the encouraging trend of falling applied tariffs in recent years, beyond commitments in Free Trade Agreements (FTAs), governments that are not party to the WTO Pharmaceutical Agreement do not have a legally binding obligation to keep tariffs low in the future. The Agreement (also known as Zero-for-Zero) covers finished pharmaceuticals and certain APIs. The rise of emerging markets means the Agreement in 2018 covered only 78% of global pharmaceutical trade, down from 90% in 1995. (GTD 2020). According to a different calculation, the value of trade taking place outside of bound zero tariffs of the WTO Pharmaceutical Agreement grew at a CAGR of 4.2% between 2006 and 2018 (Stevens and Banik 2020). Reflecting the innovation-driven model of the pharmaceutical sector, new therapies continue to be developed and manufactured to address health needs globally; however inputs to such new products are not covered by the Agreement as the API list has not been updated since 2010.

Governments can increase tariffs applied to medicines and inputs at any time. For WTO members, increases in import tariffs are generally limited by tariff ceilings that WTO members prescribe for themselves (called bound duty rates or “tariff bindings”). The frequently substantial difference between applied average tariffs and average bound tariffs (so-called tariff “water”) creates significant legal and thus value chain uncertainty for pharmaceutical manufacturers and distributors. This uncertainty may deter exports to countries where there is nevertheless patient demand.

The latest available data from the WTO shows a global average Most Favoured Nation (MFN) applied tariff on medicines of 2.1% compared to an average bound rate of 22%. In other words, the average bound rates for medicines are ten times higher than average applied rates. The WTO (2020a) further observes that only 26 of its member governments have bound all their medicines at duty free levels, with 23 members not having any binding at all (WTO, 2020a) (Table 1).

Examples of tariff “water” include 35% for pharmaceuticals (Indonesia), 62.5% for APIs (India), and 27.6% for pharmaceuticals on average across upper middle-income countries. Even low-tariff countries such as the United States have bound rates of up to 6.5% on APIs and 2.6% on pharmaceuticals (see Table 2).

The discrepancies between bound and applied tariffs create enormous uncertainty for exporters and importers of medicines, as increases in effectively applied tariff rates could come to pass. Substantial cuts in bound rates to align them with actual rates would thus promote value chain stability and predictability in tariff rates, and promote trade in health products (WHO, WIPO, WTO 2020).

Economic effects of tariffs on medicines and inputs are significant.

Data in Table 3 shows that for pharmaceuticals and APIs, current applied import tariffs are still very high for many countries, and highest in low and middle-income countries. In large countries like Brazil, India and Indonesia currently applied tariffs reach up to 14%, 10% and 5% respectively.

High-income countries also apply import tariffs with a peak applied tariff (weighted average) on pharmaceuticals of 5.1%.

Globally, applied import tariff rates are particularly high for APIs. Both the EU and US have a peak bound tariff on APIs of 6.5%. In Brazil, India and Indonesia, bound tariffs on APIs reach up to 34%, 70% and 40% respectively. Looking beyond medicines, average global tariffs for key vaccine ingredients such as adjuvants and stabilisers, antibiotics range between 2.6% and 9.4% (OECD, 2021).

For the group of low-income countries, bound rates can still reach up to 100% of the import value, unnecessarily inflating costs of local production of medicine, with adverse knock-on impacts on pharmaceutical supply and prices paid by patients and healthcare insurances (up to 80% of the ex-factory sales price, according to one recent analysis) (ECIPE, 2017).

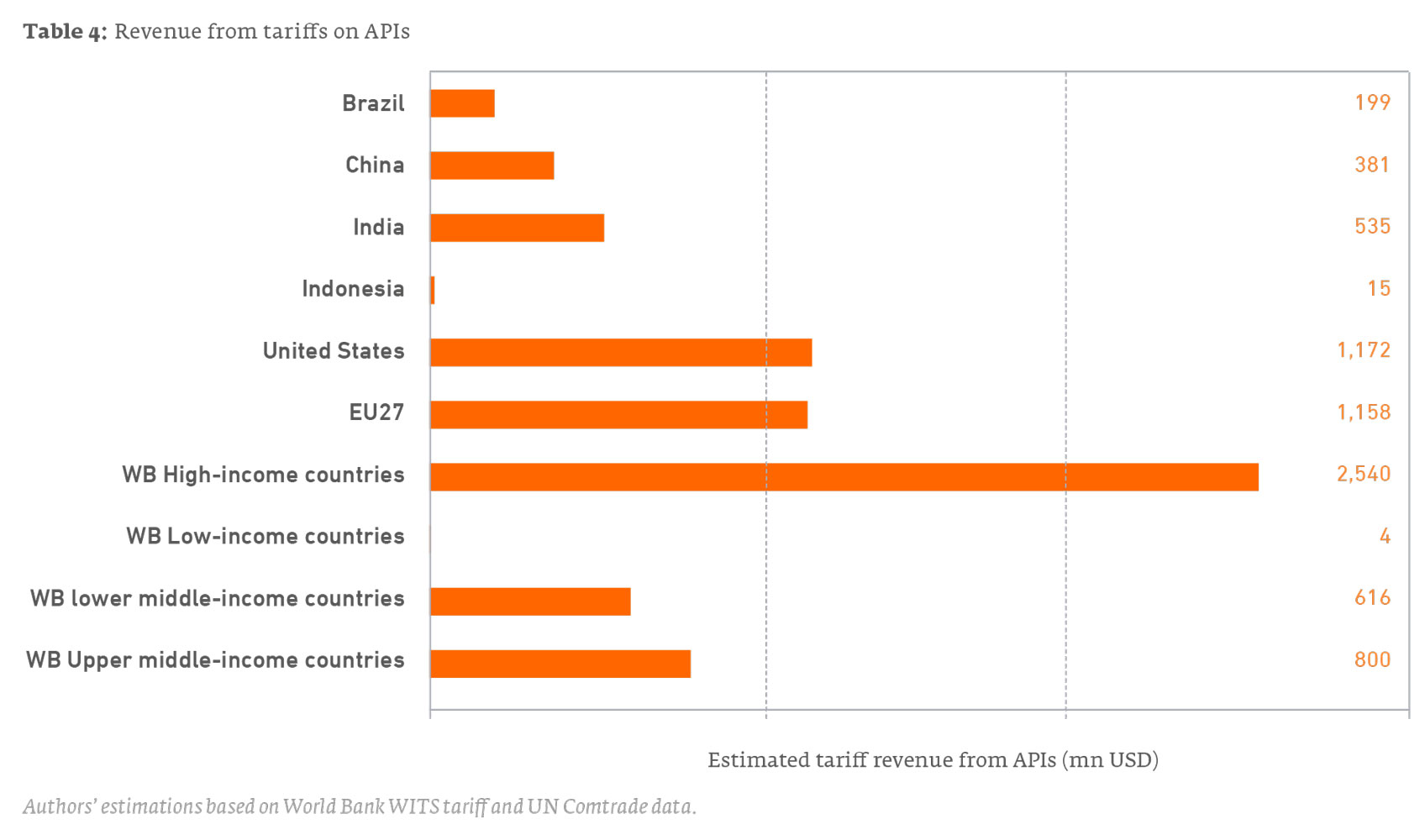

While tariffs on APIs are generally low or zero for the EU and the US, high import volumes, and the diminishing scope of coverage of the Zero-for-Zero Agreement, still result in a substantial tariff burden for importers and pharmaceutical manufactures respectively, amounting to USD1.16bn in 2018 for imports to the EU and USD1.17bn for imports to the US (Table 4). These costs are passed on to manufacturers and ultimately payers and patients.

The full global elimination of import tariffs on APIs would thus encourage companies, including producers in low- and middle-income countries, to expand production and diversify medicinal product portfolios, which would in turn benefit patients by providing access to a broader range of medicines.

Peak applied tariffs for medical equipment and supplies also impose a substantial financial burden, reaching up to 150% in India and 70% in Indonesia, as two examples (Table 5).

Medicines tariffs have significant negative effects on supply of medicines for patients.

Tariffs on medicine and inputs reduce the overall availability and supply of medicines because they increase the cost of manufacturing and of imported medicines. To illustrate the effect of tariff policies on access to medicines, we model three scenarios:

- Scenario 1: Tariff increases by US and EU, illustrating risks of trade retaliation

- Scenario 2: Tariff increases to bound rates by all jurisdictions on all medical products, to illustrate the dangers of tariffs

- Scenario 3: The global elimination of all medical tariffs

In Scenario 1 and Scenario 2, the volume of medicines imports is reduced as tariffs increase, and for countries with limited manufacturing capacity, the reduction in imports results in reduced patient access to medicines.

The full methodology, calculations, results and statistical analysis are available here.

Trade enforcement actions against medicines disrupt global value chains and limit patient access (Scenario 1)

In the first scenario, the US or EU take hypothetical enforcement actions – i.e., raise tariffs on medicines – for example in response to a trade dispute. This example is not merely hypothetical: in recent years, both the US and EU have raised or threatened to raise tariffs on some medical goods as part of a trade enforcement action; whether through WTO-sanctioned trade retaliation, or following the application of domestic trade enforcement laws.

We estimate that an increase to 25% of currently applied (zero or low) import tariffs on pharmaceuticals and APIs by the EU and the US would have significant distortive effects, including in India and China, that could significantly reduce global supply. Our estimates indicate that Chinese exports of pharmaceuticals would decrease by 81%. Chinese chemical products exports would decrease by 8%. Indian exports of pharmaceuticals would decrease by 35%. Indian chemical product exports would decline by 7%. Both countries would also experience a significant decline in the production of pharmaceuticals and chemical products. Given the importance of China and India for supplying the global generic market, these declines would translate into reduced access to medicines and higher prices in many jurisdictions.

Global actions to increase tariffs to bound rates would significantly impede affordable access to medicines (Scenario 2):

We estimate that increases in tariffs to bound rates globally would significantly reduce export and import volumes for all types of medical goods, with negative consequences for the availability of finished medicines, medical supplies, medical equipment, and personal protective products. Such a scenario also reflects the dangers of policy measures that lead to copycat measures or retaliation between countries.

The negative impacts would be most severe in economically less developed and less diversified countries, of which many currently apply very high import tariffs on various pharmaceutical and other medical products while at the same time lacking production capacities for advanced medical products.

Increases of import tariffs to current bound tariff rates would cause significant losses in imports, leaving many countries with shortages in the supply of medicines, active ingredients and medical goods. Lower income countries would be hardest hit suffering a 53% fall in imports, followed by upper-middle income countries which would fall by 24.5%. Within that, the worst hit would be Indonesia with a 44% drop in pharmaceutical imports, followed by Brazil (35%) and India (13%)

Since pharmaceutical and medical production capacities in lower- and upper- middle income countries are unlikely to replace imports in the near- to medium-term, patients in these countries would suffer most from substantially lower access to affordable medicines.

In the longer term, some of the losses in imports would be compensated by higher domestic production, but only in counties which sufficiently available production capacities and after a sufficient time to adjust. In most economically less developed countries, these shifts would particularly impact access to innovative medicines: these usually enjoy IPR protection and are unlikely to be replaced by any domestic production in the medium- to long-term, thus worsening patients’ access to novel treatments through reduced availability or substantially higher prices.

The global elimination of import tariffs on medicines, APIs and medical goods would improve access to medicines (Scenario 3).

Our estimates show that the full elimination of import tariffs on medicines and APIs globally would improve global access, including in low and middle-income countries. The full elimination of import tariffs only for pharmaceuticals and APIs would lead to a significant increase in global trade, implying increases in the quantity and variety of medicines available across countries. Patients in upper-middle income countries would enjoy an increase of 4.4% in imported medicines implying increases in the availability and variety of medicines in these jurisdictions. Patients in Brazil would have access to 7.5% more pharmaceutical imports; China 7.1% and India 5%. Locking-in zero tariffs on medicines, APIs and medical goods would not only cause short-term improvements in the supply of existing medicines, intermediates and medical goods. Innovative treatments as well as novel APIs and medical goods would be traded at lower costs, improving market penetration and patients’ access globally.

What next? Improving access to medicines by eliminating tariffs on medicines and APIs.

In light of the pandemic, many countries have put forward proposals to reduce or eliminate tariffs on medicines and APIs, as well as medical goods. Some have suggested that these initiatives could build upon the existing WTO Pharmaceutical Zero-for-Zero Agreement which has not been updated for ten years and covers a decreasing share of global trade in medicines; others have floated sectoral approaches or initiatives within regional fora. Several countries have not offered a broad proposal but have at their own initiative temporarily suspended tariffs on medical goods in light of the pandemic.

The economic estimates detailed in this brief demonstrate that eliminating tariffs on medicines and inputs creates material benefits for patients both in terms of cost and availability of supply. Tariff elimination, whether through the WTO Pharmaceutical Agreement or other initiatives, should therefore be an important component of any effort by governments to improve trading rules to support public health objectives.

Bibliography

ECIPE (2017). The Compounding Effect of Tariffs on Medicines: Estimating the Real Cost of Emerging Markets’ Protectionism. ECIPE Policy Brief 01/2017. Available at https://ecipe.org/wp-content/uploads/2017/09/Tariffs-on-medicines-final.pdf.

GTD (2020). Free Trade Trade in Medicines and Supplies is the Healthiest Approach. Global Trade Daily, International Trade. Available at https://www.globaltrademag.com/author/durkincalder/.

IMF (2019). Macroeconomic Consequences of Tariffs. IMF Working Paper WP/19/9.

OECD (2021), Using trade to fight COVID-19: Manufacturing and distributing vaccines, 2021. Available at: https://www.oecd.org/coronavirus/policy-responses/using-trade-to-fight-covid-19-manufacturing-and-distributing-vaccines-dc0d37fc/#figure-d1e465

Olcay, M., and Laing, R. (2005). Pharmaceutical Tariffs: What is their effect on Prices, Protection of Local Industry and Revenue Generation?. Report Prepared for: The Commission on Intellectual Property Rights, Innovation and Public Health. Available at https://www.researchgate.net/publication/228389566_Pharmaceutical_Tariffs_What_is_their_effect_on_prices_protection_of_local_industry_and_revenue_generation.

Stevens, P. and Banik, N. (2020). Abolishing pharmaceutical and vaccine tariffs to promote access. Geneva Network research paper. Available at https://geneva-network.com/research/2020-pharmaceutical-tariffs/.

WTO (2020a). Trade in medical products in the context of tackling Covid-19. Available at https://www.wto.org/english/news_e/news20_e/rese_03apr20_e.pdf.

WHO (2003). How to Develop and Implement a National Drug Policy, Geneva. Available at https://www.who.int/management/background_4b.pdf.

WHO WIPO WTO (2020). Promoting Access to Medical Technologies and Innovation, 2nd edition, Intersections between public health, intellectual property and trade. Available at https://www.wto.org/english/res_e/booksp_e/who-wipo-wto_2020_e.pdf.